how are property taxes calculated in fl

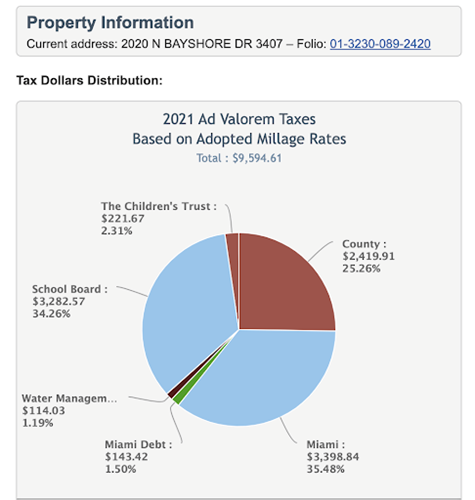

This keeps the assessed value from going up more than 3 a year for a primary residence. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home valueA number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Real Estate Property Tax Constitutional Tax Collector

The millage rate for Boca Raton is 18307 per 1000 of value so you are paying.

. Then all there is left to do is to pay Florida property tax. For a more specific estimate find the calculator for your county. House in Miami 20780 Property TaxYear.

The highest rate therefore i in Biscayne Park with 25 mills. To calculate the property tax use the following steps. The median property tax on a 18240000 house is 191520 in the United States.

Please note that we can only estimate your property tax based on median property taxes in your area. Property taxes must be paid in full at one time unless on the partial payment plan Multiple checks must be sent in the same envelope. Search Any Address 2.

Just Value Assessment Limits Assessed Value. The median property tax on a 18240000 house is 176928 in Florida. Reduce property taxes for yourself or others as a legitimate home business.

Property values are usually determined by a local or county assessor. Find County Online Property Taxes Info From 2021. 097 of home value.

Tax amount varies by county. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. The latter is usually the wildcard.

Average Property Tax in Florida Per County. Florida Property Tax Rates Property taxes in Florida are implemented in millage rates. Here like in all of Florida property taxes are calculated in millage rates.

Thomas Pinellas County Tax Collector. Here are the median property tax payments and average effective tax. The simple formula is Taxable Value x Millage Rate rate per 1000 of value.

See Property Records Tax Titles Owner Info More. This equates to 1 in taxes for every 1000 in home value. Your property tax is determined by the taxable value multiplied by the county millage rate.

If values are rising faster than 3. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. These lie between 17 and 25 mills.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. While observing constitutional limitations prescribed by statute the city creates tax rates. To determine your tax liability use the Florida property tax calculator below.

This estimator is based on median property tax values in all of Floridas counties which can vary widely. Find the assessed value of the property being taxed. Taxable Value Millage Rate Total Tax Liability.

By Mail with a Check. Real property evaluations are carried out by the county. Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes.

There are some protections in place to prevent the abuse of assessed values. Ad Reduce property taxes for yourself or residential commercial businesses for commissions. Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes.

Answer 1 of 3. A number of different authorities including counties municipalities school boards and special districts can levy these taxes. Florida is ranked number twenty three out of the fifty states in.

One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable. When it comes to real estate property taxes are almost always based on the value of the land. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

As will be covered further appraising property billing and collecting payments conducting compliance measures and clearing discord are all reserved for the county. More complicated is the assessed value due to Floridas Save Our Homes cap. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Its a little different in GA but similar in that the millage rates varied widely from county to county. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. The more valuable the land the higher the property taxes.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Assessed Value Exemptions Taxable Value. Ad Get Record Information From 2021 About Any County Property.

Florida Property Tax Rates Property taxes in Florida are implemented in millage rates. Please make your check payable to.

Secured Property Taxes Treasurer Tax Collector

Property Tax Prorations Case Escrow

Your Guide To Prorated Taxes In A Real Estate Transaction

How To Calculate Fl Sales Tax On Rent

How Much Florida Homeowners Pay In Property Taxes Each Year Florida Thecentersquare Com

Property Tax How To Calculate Local Considerations

A Guide To Your Property Tax Bill Alachua County Tax Collector

How Property Taxes Are Calculated

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

Florida Property Tax H R Block

Duval County Fl Property Tax Search And Records Propertyshark

Florida Property Taxes Explained

What Is Florida County Tangible Personal Property Tax

What Is A Homestead Exemption And How Does It Work Lendingtree

How To Calculate Property Tax And How To Estimate Property Taxes